If you are still managing your delinquency queues with spreadsheets or legacy core reports, you are likely feeling the tremors of what’s coming.

For the last two years, we’ve heard about “rising risk.” But the latest data from Q3 2025 suggests the dam is finally starting to crack. According to Fitch Ratings, 6.65% of subprime auto borrowers were 60+ days late in October—the highest rate recorded since data tracking began in 1993.

For community banks and credit unions, this is the canary in the coal mine.

While overall credit union delinquency rates have stabilized slightly at 0.95%, the severity of those delinquencies is increasing. The Federal Reserve Bank of New York reports that 3.03% of balances are now flowing into “serious delinquency” (90+ days).

The “Manual” Trap

In 2020, you could manage a delinquency queue manually because the volume was manageable. Today, with $18.59 trillion in household debt, the volume has outpaced human capacity.

When a collector spends 20 minutes manually calculating a charge-off balance or digging through core screens to find a phone number, that is 20 minutes they aren’t calling a borrower who is about to roll into the 90-day bucket.

The 2026 Mandate: Automation

To survive the 2026 credit cycle, institutions must shift from “reactive” to “proactive.” This means:

Automating “Nudges”: Sending emails/texts at 10 days past due automatically, so collectors focus on the 60+ day risks.

Unified Data: Seeing a member’s auto loan, credit card, and deposit relationship on one screen.

Shadow Accounting: Automating the complex math of charge-offs and recoveries (RAM) to satisfy auditors without the spreadsheet headaches.

The storm isn’t coming; it’s here. The only question is whether your collections team has the right umbrella.

Clip & Save: The 2026 Collections Watchlist

Use this quick reference guide to benchmark your institution’s performance against the latest Q3 2025 industry risk factors.

1. The “Danger Zone” Statistics (Q3 2025 Update)

Recent Federal Reserve, NCUA, and Fitch Ratings data confirm consumer credit risk is accelerating in specific, high-danger pockets.

Household Debt Record: $18.59 Trillion (Up $197 Billion in Q3 2025 alone).

Credit Union Delinquency Rate: 0.95% (Remains elevated near historic highs).

Subprime Auto Risk: 6.65% of subprime borrowers were 60+ days late in October 2025—a 30-year high.

Serious Delinquency Flow: 3.03% of all balances transitioned to 90+ days delinquent this quarter.

Student Loan Delinquency: 9.4% of student debt is now 90+ days delinquent (up from 7.8% in Q1).

The Takeaway: While overall delinquency looks flat, the severity is spiking. The flow into “Serious Delinquency” (3.03%) means that once borrowers fall behind, they are finding it harder to catch up.

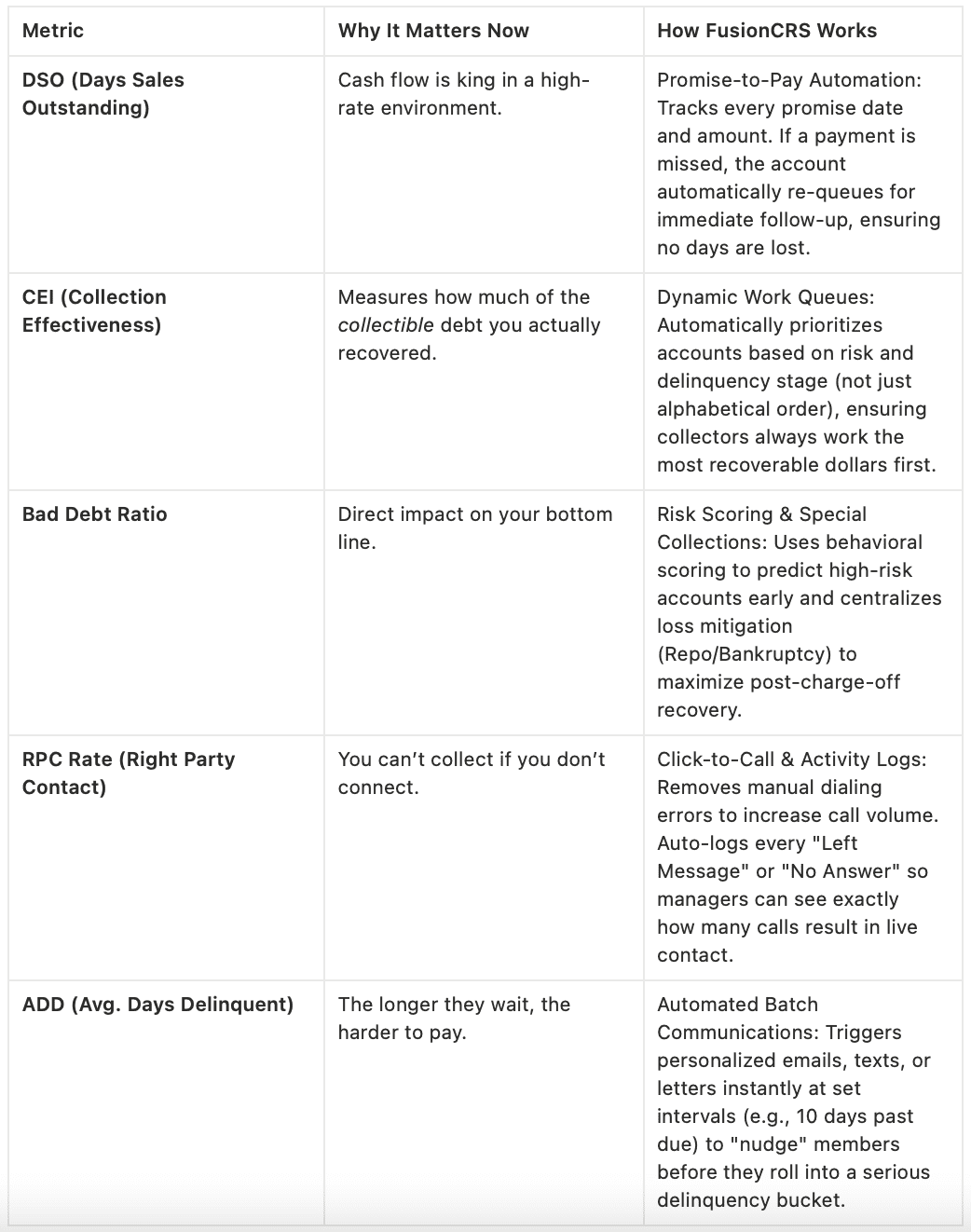

2. The 5 “Survival KPIs” You Must Track

If you aren’t automating these metrics, you are flying blind.

3. The “Silent Killer” of Member Loyalty

Why automation is actually safer for relationships than manual calling.

According to CFPB data, the top complaint themes aren’t about paying debt—they are about process errors:

53% of complaints are about attempting to collect debts not owed.

Documentation errors and unclear fees are primary friction points.

The Automation Advantage:

A system like FusionCRS creates an immutable “Audit Trail” for every account. It ensures you never call a member who already paid, and it keeps your documentation perfect for regulators.

4. Final Thought for 2026

“In uncertain economic times, automation isn’t just about efficiency—it’s survival. With subprime auto delinquencies at a 30-year high of 6.65%, manual spreadsheets can no longer keep up with the risk.”

Ready to automate your collection and recovery processes? Contact sales@fintegratetech.com.