Innovative, collection, recovery and dispute management software to help financial institutions.

Innovative, collection, recovery and dispute management software to help financial institutions

improve operational efficiencies, reduce costs and maintain compliance.

Collection Recovery

Consolidated database for Collections, Loss Mitigation and Recoveries.

Collection Recovery

From early-stage delinquencies and loss mitigation management, to charge-off recovery management and accounting, FusionCRS can handle it all.

learn more

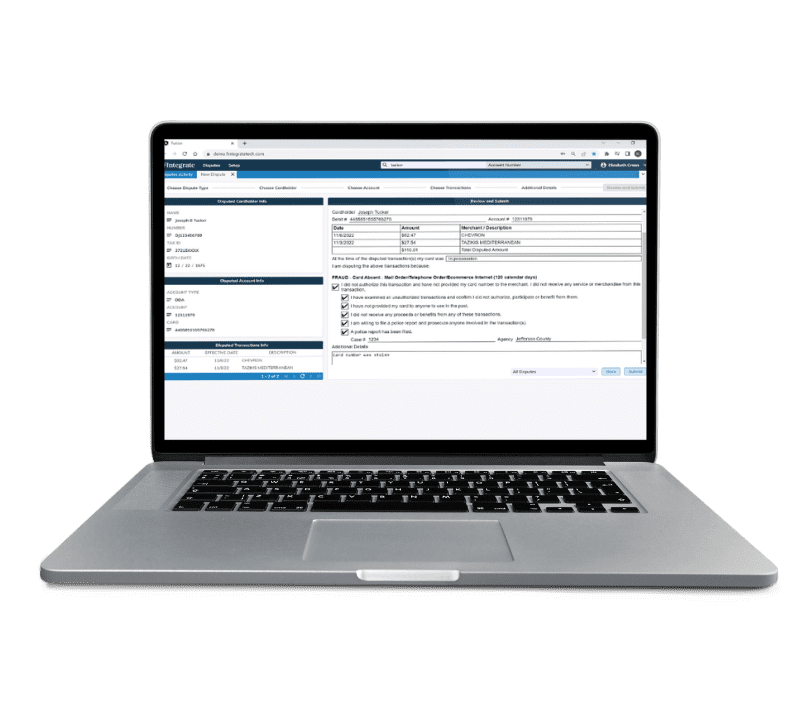

Dispute Management

Intuitive, automated work queues to do more, with less.

Dispute Management

Our dispute management technology helps financial institutions streamline dispute workflow, improve productivity and maintain compliance. Our consolidated platform provides centralized management for all types of disputes.

learn more

Collections & Recoveries

Consolidated database for Collections, Loss Mitigation and Recoveries.

Collections & Recoveries

From early-stage delinquencies and loss mitigation management, to charge-off recovery management and accounting, FusionCRS can handle it all.

learn more

Maintain Compliance

Our technology helps financial institutions maintain compliance.

Maintain Compliance

Our dispute management technology helps financial institutions streamline dispute workflow, improve productivity and maintain compliance. Our consolidated platform provides centralized management for all types of disputes.

learn more

Reduce Cost

Intuitive, automated work queues to do more, with less.

Reduce Cost

We achieve significant cost reductions and efficiency improvements through automation and effective multi-channel communications.

learn more

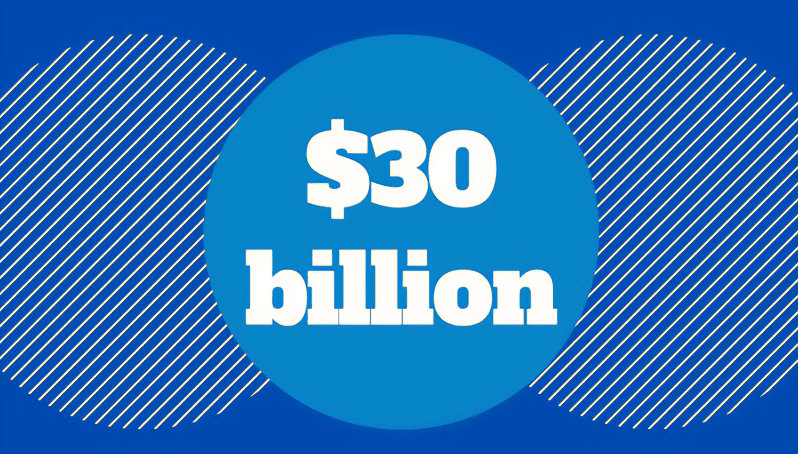

FusionCRS collections and recovery software tracks more than

$30 Billion in loans each day.

our software does more

FusionCRS manages over $30 billion in delinquent loans daily

One system for early-stage delinquencies through charge-off recoveries

Add Your Heading Text Here

Concierge-Level Service

Our Robust, fully automated, collections and recovery system helps financial institutions reduce delinquencies, improve collections at a much lower cost, and improve your loan loss reserve requirements through highly advanced data analytics and workflows that predict, automate, and consolidate manual processes into one streamlined platform. Fusion CRS can handle delinquency risk scoring through asset recovery accounting and reporting.

100+

Years of combined experience

The FIntegrate team brings decades of proven success and experience.

At Fintegrate Technology we provide data-driven analytics software focused on portfolio tracking and revenue recovery for financial institutions.

Increase recovery revenue on average by 25%

25%

Reduce annual collection expenses by 33%

33%

Improve productivity by up to 70%

70%

“We consolidated onto the FIntegrate platform and couldn’t be more pleased! Last but not least, the support provided by the team has been outstanding!”

Sarah Gregerson Loan Recovery Supervisor

"We are excited (as you can be for compliance). We have looked at several REG E Dispute Management systems, but this is the first that was a universal yes from all parties."

Franklin E. WeberEVP, COO & Cashier our network

Proudly Partnered With

News & Blog

Latest Articles

Increase Revenue

At Fintegrate Technology we provide data-driven analytics software focused on portfolio.

Increase Revenue

At Fintegrate Technology we provide data-driven analytics software focused on portfolio.